Can I Write Off Tools For Work 2024

Can I Write Off Tools For Work 2024. For 2023, you can deduct up to $6,500 of contributions to a traditional ira. A credit cuts your tax bill directly.

Solved•by turbotax•5098•updated december 11, 2023. Tools and supplies when used for essential work, your tools and supplies may count as unreimbursed.

In This Guide, We’ll Cover Everything You Need To Know About Writing Off Meals:

That means they end up over paying the irs, by about 21%.

As A Business Owner, The Easiest Way To Reduce Your Taxes Is Through Small Business Tax Deductions.

What can you write off?

For 2023, You Can Deduct Up To $6,500 Of Contributions To A Traditional Ira.

Images References :

Source: www.vrogue.co

Source: www.vrogue.co

The Deductions You Can Claim Hra Tax Vrogue, Cut taxes by deducting various expenses. If you’re eligible to take it, you can.

Source: www.goldenappleagencyinc.com

Source: www.goldenappleagencyinc.com

Can You Write Off Tools for Work? 2023 Deductions Guide, Deduction for tools (tradespersons) if you were a tradesperson in 2023, use the following formula to calculate your maximum tradesperson's tools deduction for the cost of eligible tools. Small businesses can save on travel, office supplies, and more.

Source: www.oliverelliot.co.uk

Source: www.oliverelliot.co.uk

Can You Write Off A Bounce Back Loan? Oliver Elliot, Speaking of which, the irs doesn’t allow deductions for educational expenses that help you meet the “minimum requirements” to offer services in a new field. For 2023, you can deduct up to $6,500 of contributions to a traditional ira.

Source: thelittlelist.net

Source: thelittlelist.net

Can I write off gas for DoorDash? TheLittleList Your daily dose of, Small businesses can save on travel, office supplies, and more. For 2023, you can deduct up to $6,500 of contributions to a traditional ira.

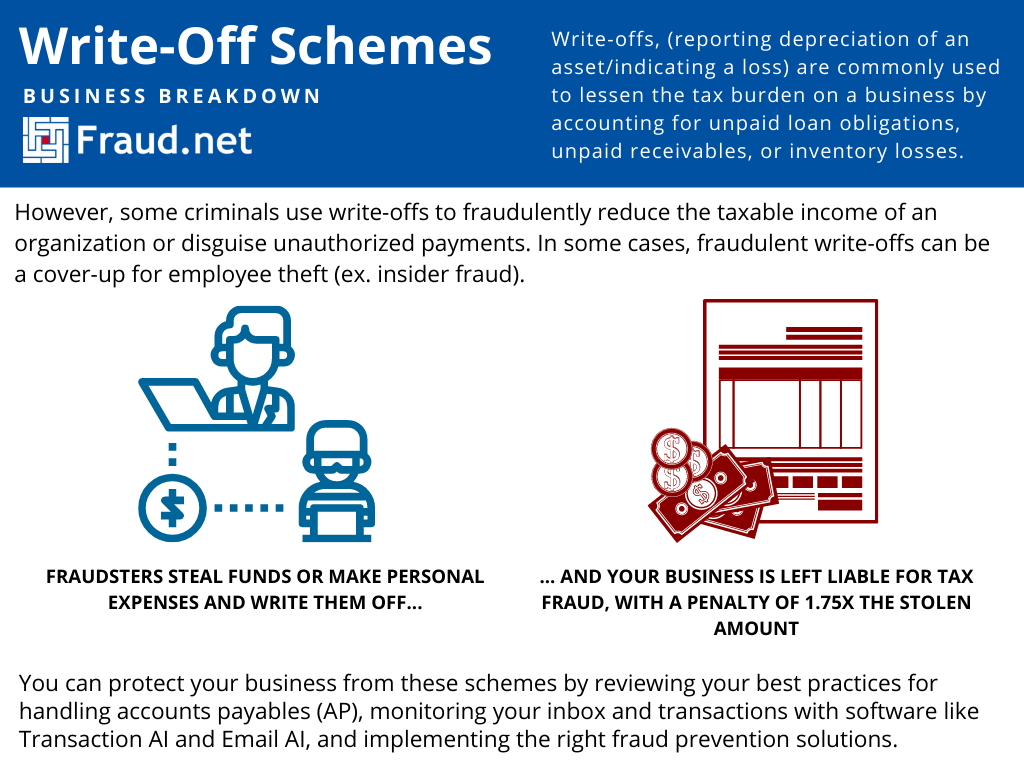

Source: fraud.net

Source: fraud.net

Define WriteOff Schemes Fraud Definitions, Tools and supplies when used for essential work, your tools and supplies may count as unreimbursed. Learn about the tax breaks available.

Source: www.educba.com

Source: www.educba.com

Write off Why Assets Are Written off with Explanation, Tools and supplies when used for essential work, your tools and supplies may count as unreimbursed. If you offer mechanic services from your home garage, you're of course eligible to claim home office deductions.

Source: nexgen.com.au

Source: nexgen.com.au

Instant Tax Write Off Office Communications Nexgen, In order to write off tools on your taxes, it is important to understand what types of tools qualify for deduction and how much you can deduct for each. That means they end up over paying the irs, by about 21%.

Source: www.orcuttfinancial.com

Source: www.orcuttfinancial.com

11 Tax Deductions for Small Businesses Orcutt & Company, You can deduct the cost of the tools as an unreimbursed employee expense on schedule a if both of these apply: For certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2022, and before january 1, 2024, you can elect to take a special depreciation.

![What Can You Write off on Your Taxes [INFOGRAPHIC] Tax Relief Center](https://help.taxreliefcenter.org/wp-content/uploads/2018/01/Tax-Relief-Center-5-Things-You-Can-Write-Off-From-Your-Taxes-20190516.jpg) Source: help.taxreliefcenter.org

Source: help.taxreliefcenter.org

What Can You Write off on Your Taxes [INFOGRAPHIC] Tax Relief Center, In this guide, we’ll cover everything you need to know about writing off meals: What can you write off?

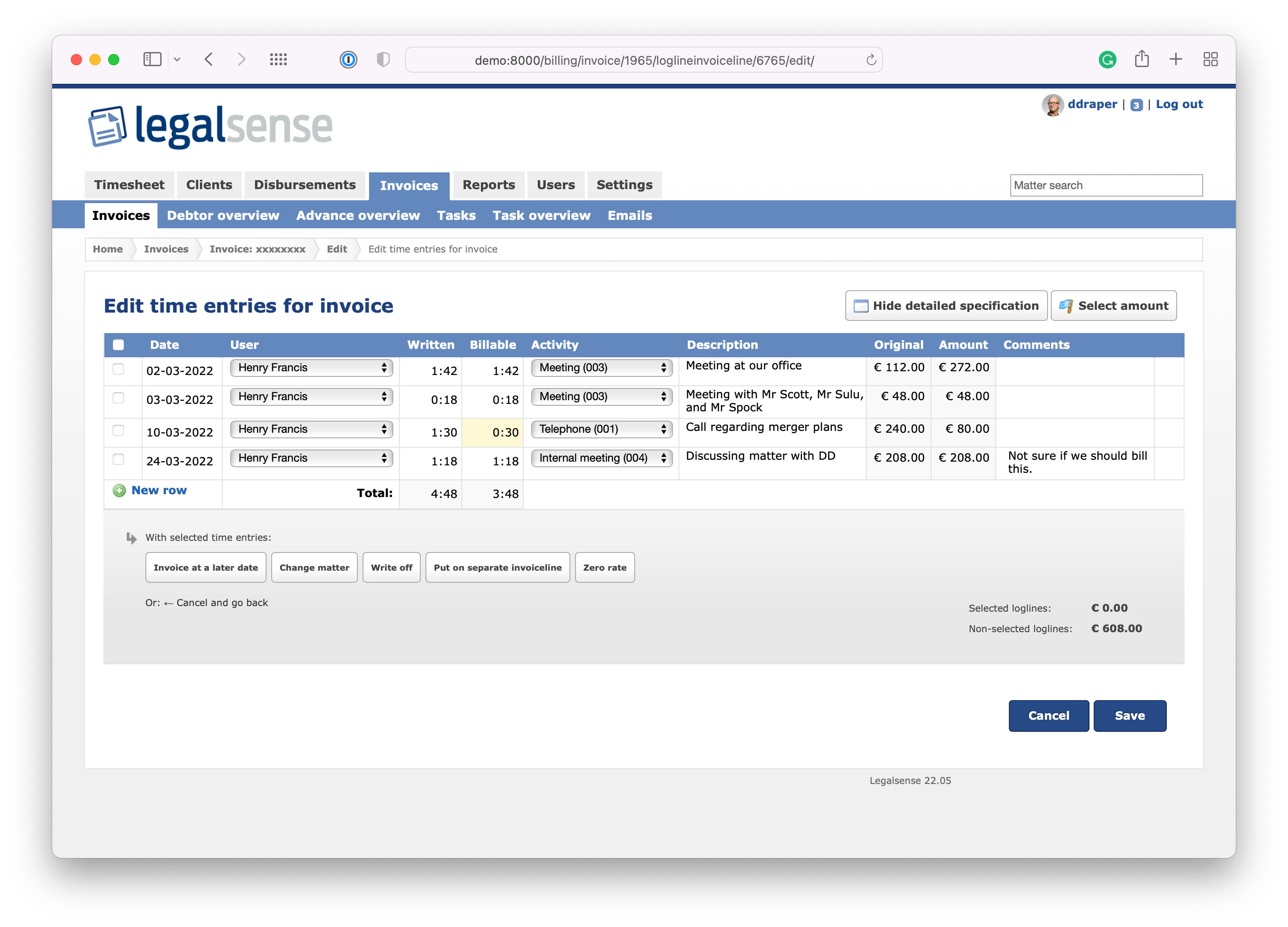

Source: support.legalsense.nl

Source: support.legalsense.nl

Release 22.05 May 2022 Legalsense, In order to write off tools on your taxes, it is important to understand what types of tools qualify for deduction and how much you can deduct for each. But don't forget to also take into account the time you spend working from.

What Can You Write Off?

Reduce your tax bill by taking advantage of business tax deductions.

Small Businesses Can Save On Travel, Office Supplies, And More.

In order to write off tools on your taxes, it is important to understand what types of tools qualify for deduction and how much you can deduct for each.