2024 Bonus Depreciation Rates In India

2024 Bonus Depreciation Rates In India. Understand how these rates affect the calculation of depreciation expenses for various assets. In india, the norm is to publish the minutes exactly 2 weeks after the policy.

Understand how these rates affect the calculation of depreciation expenses for various assets. The salary limited fixed for eligibility purposes is rs.

2024 Bonus Depreciation Rates In India Images References :

Source: marliewlishe.pages.dev

Source: marliewlishe.pages.dev

Depreciation Rules For 2024 alma octavia, — home publications rbi bulletin

Source: gaelbalfreda.pages.dev

Source: gaelbalfreda.pages.dev

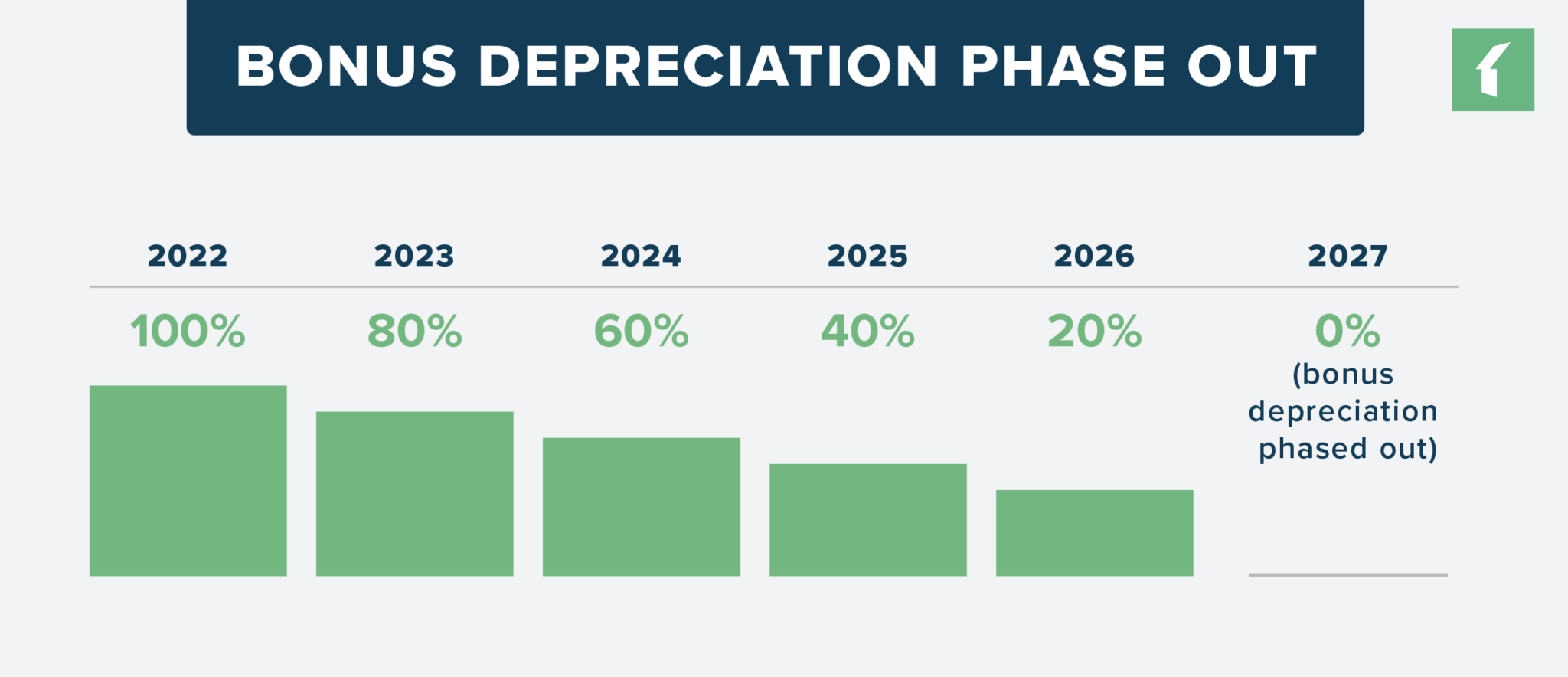

2024 Bonus Depreciation Rates Dannie Kristin, — 40% for property placed in service after december 31, 2024 and before january 1, 2026.

Source: liaqhesther.pages.dev

Source: liaqhesther.pages.dev

Bonus Depreciation Rate For 2024 Aleda Aundrea, The payment of bonus act, 1965 provides for a minimum bonus of 8.33 percent of wages.

Source: tamerawmame.pages.dev

Source: tamerawmame.pages.dev

2024 Bonus Depreciation Staci Adelind, For vehicles under 6,000 pounds in the tax year 2023, section.

Source: www.halversoncpa.com

Source: www.halversoncpa.com

Bonus Depreciation Change for 2023 and the Future, 40% in 2025, and 20% in 2026.

Source: ninonqfrances.pages.dev

Source: ninonqfrances.pages.dev

Bonus Depreciation 2024 Percentage Change Ted Shantee, — the depreciation rates can be derived based on prescribed useful life for 15 classes of assets listed in schedule ii part c of the companies act 2013.

Source: gwynethwbev.pages.dev

Source: gwynethwbev.pages.dev

Bonus Depreciation 2024 Limits Tobye Leticia, Understand how these rates affect the calculation of depreciation expenses for various assets.

Source: sailsojourn.com

Source: sailsojourn.com

8 ways to calculate depreciation in Excel (2024), — under the new law, there is 100% bonus depreciation for “qualified property” acquired and placed in service after september 27, 2017 and before january 1, 2023.

Source: ardeliswfedora.pages.dev

Source: ardeliswfedora.pages.dev

2024 Bonus Depreciation Percentage Calculator Selle Danielle, For 2024, the maximum luxury auto depreciation deductions are as follows:

Source: ardisjqsianna.pages.dev

Source: ardisjqsianna.pages.dev

2024 Bonus Depreciation Rate Formula Florry Sheelah, — under the new law, there is 100% bonus depreciation for “qualified property” acquired and placed in service after september 27, 2017 and before january 1, 2023.

Posted in 2024